Welcome to the exciting world of stock market trading, where investors are always on the lookout for creative strategies to boost their chances of success. One strategy that’s been making waves is the practice of combination trades. It’s all about juggling multiple options or derivatives at once, buying and selling them in harmony to ride the waves of an underlying asset’s movements while keeping risks at bay. Whether you’re just starting out as a trader or you’re a seasoned pro looking to up your game, getting the hang of combination trades could be your golden ticket to triumph. So, let’s dive in and explore this intriguing approach.

Unraveling the Concept of Combination Trades

Before diving into the why and how of combination trading, it’s essential to grasp the fundamentals. A combination trade entails a trader’s simultaneous engagement in the purchase and sale of derivatives, such as options and futures contracts, across different markets but related to the same underlying asset. In essence, it positions the trader with both a long (buy) and a short (sell) exposure to two instruments connected to the underlying asset. Leading brokerage firms, including the likes of Saxo Markets, facilitate combination trades, enabling investors to harness opportunities across single stocks, indices, commodities, and more.

The primary objective of these trades is risk reduction, achieved by creating a hedge against potential losses stemming from price movements. When executed strategically, combination trades empower investors to benefit from favorable price movements in either of the investments while cushioning the blow if one part of the trade falters.

The Compelling Case for Combination Trades

Why opt for combination trades, you might ask? There are several compelling reasons:

1. Risk Mitigation: The cornerstone of combination trades is risk reduction. By holding both long and short positions on related instruments, investors can safeguard their portfolios against severe losses, even if one part of the trade underperforms.

2. Enhanced Opportunities: Combination trades offer the potential for amplified returns compared to traditional investments in the underlying asset. Options and futures contracts, which form the bedrock of combination trading, provide leverage, enabling investors to garner more significant returns with a lesser capital outlay.

3. Portfolio Management: These trades serve as an effective tool for managing a diversified portfolio. They act as a hedge, shielding investors from market downturns and reducing the overall risk exposure within their investment mix.

Executing a Combination Trade

Now, let’s walk through the steps to execute a combination trade effectively:

- Select Underlying Assets: Begin by identifying the two or more underlying assets you wish to incorporate into your combination trade. These assets can span stocks, commodities, currencies, indices, or any other financial instruments that align with your trading strategy.

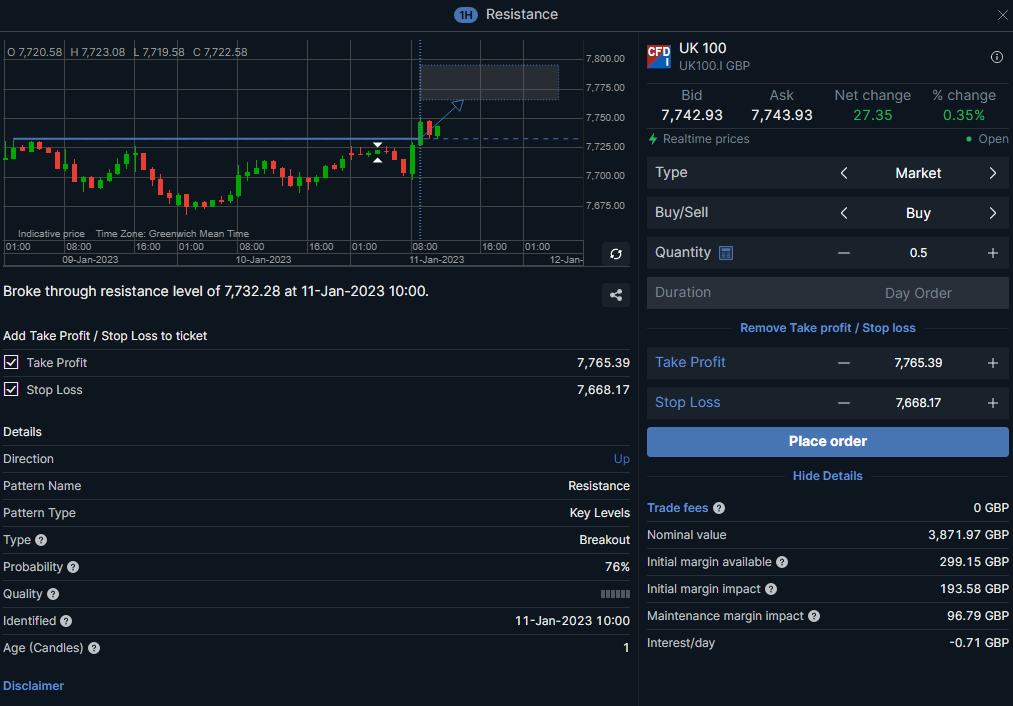

- Choose Your Trade Type: Options and futures contracts are the primary derivatives used in combination trades. It’s crucial to weigh the cost and complexity of each option before making a decision. Some brokerages offer simplified options trading, while others demand a deeper understanding of the market.

- Set Parameters: Define the parameters of your combination trade, specifying the nature of the options and futures contracts you intend to use. It’s equally important to establish a robust risk management strategy, ensuring that one part of the trade can offset potential losses in the other.

Pros and Cons of Combination Trades

As with any trading strategy, combination trades come with their set of pros and cons:

Pros:

- Risk Reduction: Combination trades are a potent tool for mitigating risk, creating a buffer against substantial losses in volatile markets.

- Enhanced Opportunities: Leverage inherent in options and futures contracts can lead to more significant returns with a relatively modest capital investment.

- Portfolio Diversification: They enable effective portfolio management by acting as a hedge during market downturns, safeguarding overall investments.

Cons:

- Complexity and Costs: Execution of combination trades can be complex and costly. Brokerages often charge additional fees for options and futures trading, and a deep understanding of the market is essential.

- Risk of Misuse: If employed incorrectly or without adequate risk management, combination trades can be risky. A misjudgment in one part of the trade may result in losses, even if the other portion succeeds.

- Complexity Challenges: The intricacies of combination trades can escalate quickly. Traders must develop a clear strategy and ensure a deep comprehension of how the different elements interact.

In conclusion, combination trades represent a compelling approach to navigate the stock market’s complexities, offering a balance between risk and reward. By harnessing the power of simultaneous long and short positions in derivatives, investors can protect their portfolios while seeking enhanced returns. However, it is vital to approach combination trading with careful consideration, armed with a comprehensive understanding of its intricacies and a well-thought-out strategy. When executed judiciously, combination trades can be a valuable tool in the arsenal of traders aiming to excel in the ever-evolving world of finance.